September 26, 2008

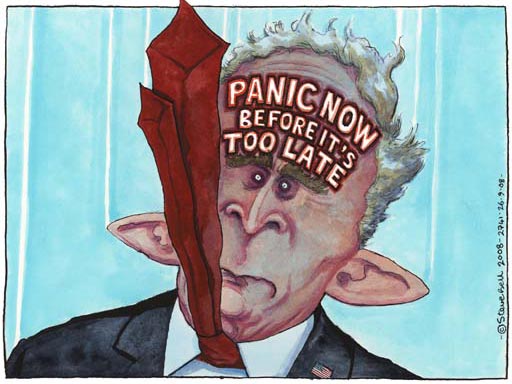

Be positive... or else

The problem with Barbara Ehrenreich's piece on Alternet, "How Positive Thinking Wrecked The Economy", is its concluding suggestion that, "[w]hen it comes to how we think, 'negative' is not the only alternative to 'positive.' As the case histories of depressives show, consistent pessimism can be just as baseless and deluded as its opposite. The alternative to both is realism -- seeing the risks, having the courage to bear bad news, and being prepared for famine as well as plenty." The problem is that this has no purchase on the inherently hyperstitional dynamics of capitalism. If the magical thinking that Enherenreich decries cannot be considered only delusional, it's because, in the markets, it's not possible to separate out beliefs from their objects. Beliefs don't register the true or falsity of propositions; rather, in the classic hyperstitional self-fulfilling loop, beliefs themselves determine value (and its destruction, as this meta-warning in The Economist points out). "Realism" isn't an available orientation. Moreover, the loop works both ways: as Robert Shiller pointed out in Irrational Exuberance, booms produce the euphoric psychological states necessary for their own maintenance.

There's an interesting parallel between this necessity of positive thinking on the markets and Cognitive Behavioural Therapy (recently attacked by Darian Leader in The Guardian). Cognitive Behavioural therapists draw on data which suggests that most people survive everyday life by having an inflated idea of their own abilities. "Realism" would therefore be dysfunctional (and would be likely to lead to depression), just as "positive thinking" increases people's confidence and capacities. Leader attacks Cognitive Behavioural Therapy for being a market-driven, quick-fix solution to psychological problems which require longer term (psychoanalytic) treatment, but it is the idea that positive thinking is mandatory which most closely links neoliberalism and CBT.

Posted by mark at September 26, 2008 01:49 PM | TrackBack